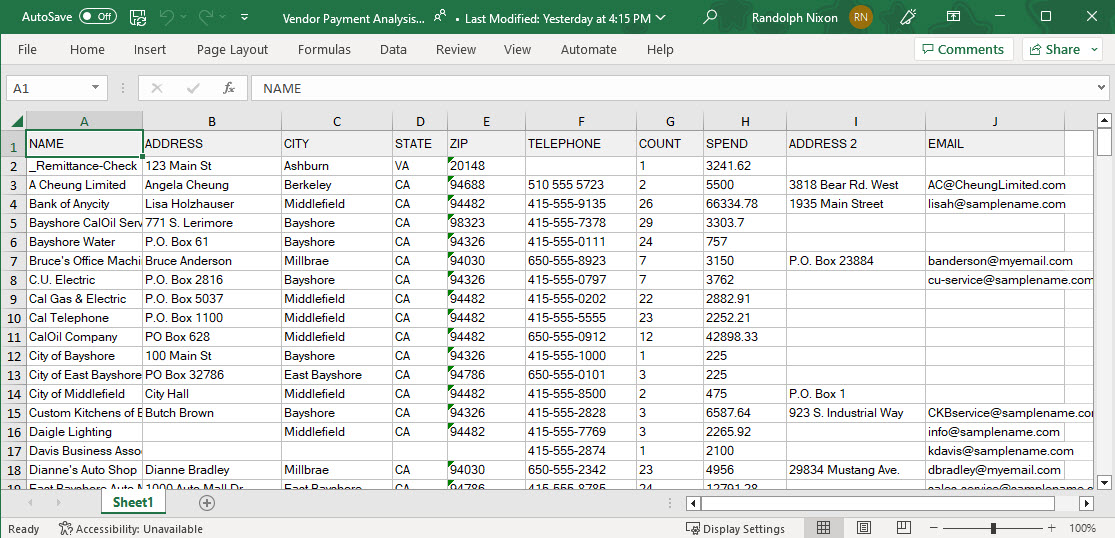

Opportunity Lost?

Today most banks are asking QuickBooks clients to manually generate reports from QuickBooks, merge results and format to their specifications. Not simple or automated and very time consuming! The result of this process is sales officers skip working with QuickBooks clients or prospects bail before ever being qualified.

How import is this segment? One Bank client has used our Vendor Payment Analysis tool to close over 400 purchasing card clients with average monthly spend of $77K. In the group multiple clients have grown to be much more than a small business. One of the 400 now has revenue over $1B, others over $100M. If you wait until they are $1B company, how easy is the sale? Can you afford not to go after the market?